Sector growth

In order to grow into a thriving city, Bournemouth, Christchurch and Poole needs to meet the existing demand and create space for growth across the different sectors

.png)

In order to grow into a thriving city, Bournemouth, Christchurch and Poole needs to meet the existing demand and create space for growth across the different sectors

Investment in infrastructure is needed to improve connectivity across the urban area and to the north, east and west, including key cities of London, Bristol and Southampton. Infrastructure improvements could include schemes such as putting on new faster bus routes with smart ticketing and timetabling apps, some form of rapid light transit system, a new link road from Poole to the A31 and improving rail connectivity.

Strategic infrastructure improvements such as these can be achieved with greater influence and funding and will open up new areas in BCP for residential and commercial development.

We have examined the needs within the three key property sectors identifying where there are growth opportunities as a result of the combined authority.

There has been an undersupply of housing in BCP over the last twenty years, partly due to the constraints of the sea, heath land and tight Green Belt. Between them BCP are building 1,300 homes per year. This is 38% below the government’s published standard assessment of housing need of 2,160 homes per year, which takes market signals into consideration. The new unitary authority will need to produce a new Local Plan which is likely to use the current MHCLG published standard assessment of housing need figures based on 2014 household projections. The ambition to grow employment in the area also means that the housing need would be higher than this.

Only 7% of the additional homes built in BCP in 2016/17 were submarket homes. The provision of sub market housing has been constrained by focus of development on brownfield land where costs are high and by smaller sites which do not require it. However, supported by the new local authority framework, the LEP aim to secure a government affordable housing deal worth £215 million for Dorset.

Private renting is more common in BCP than the national average: 31% of households in Bournemouth and 23% of households in BCP rent privately (22,000 households) compared to 18% nationally.

Between 2001 and 2011, 78% more households in BCP privately rent. With affordability pressures and a large and growing private rented sector, there is the opportunity to build more homes for private rent to help meet the local need. One Build to Rent scheme is under construction and another recently completed in Bournemouth. These are adding 266 new rental homes and leading the way in the sector.

In Bournemouth the town centre has been the focus of large-scale residential development through the Bournemouth Town Centre Action Plan. This has in part been driven by the Bournemouth Development Company, a public-private partnership between Bournemouth Borough Council and Morgan Sindall Investments Ltd, who have focussed on redeveloping car parks.

This reflects a wider pattern in Bournemouth of residential development through change of use and conversion: over 40% of the supply in Bournemouth in the last year has been provided this way. But there is a limited supply of buildings for conversion to residential and therefore alternative sites will be required to meet the need.

In Poole, there is potential for significant residential development on brownfield sites as part of the town centre regeneration. Infrastructure improvements, such as the Twin Sails Bridge and the recent £23.3 million transport improvements for accessing the Port of Poole, have been positive steps to enabling development, however viability remains a barrier to building even with the authority accepting 10% affordable housing on town centre schemes. While Poole propose releasing 1,300 homes in the Green Belt in their draft Local Plan, unlocking brownfield sites will be critical to meeting housing need.

Christchurch is constrained by flood risk area and 53% of the homes built in the five years to 2016/17 have been through redevelopment of the urban area. Brownfield land has been identified for the delivery of more new homes, particularly in Christchurch Town Centre and in Highcliffe. Christchurch also proposes releasing land in the Green Belt to meet the local need.

Take the train

Improving rail services can increase frequency and capacity of trains and also increase values around stations. Our research shows that, on average, house price growth has been 5% higher around stations than neighbouring areas where there have been greater passenger numbers (see Savills Market in Minutes: New Homes and Infrastructure – February 2018). Additionally, some of the strongest office rental uplift in Birmingham is for refurbished schemes in close proximity to the recently upgraded New Street Station (see Savills Birmingham Office Market Watch – May 2018).

Best practice across BCP can be brought together to provide the homes needed across the area.

Brownfield sites

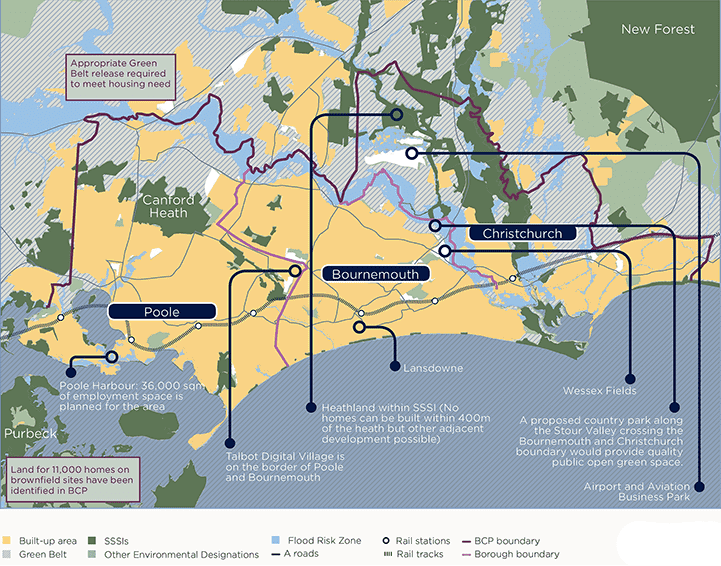

Land for up to 11,000 homes has been identified on the brownfield sites across Bournemouth, Christchurch and Poole by the National Housing Federation. However, many of these sites will be challenging to develop due to remediation costs and significant grant funding will be needed to unlock them.

The Bournemouth Development Company has the opportunity to expand its remit of redeveloping suitable car parks in Bournemouth to Poole and Christchurch.

Building on brownfield sites will go some of the way to providing the homes needed across the area.

.png)

Green belt release

Strategic Green Belt release in the most appropriate areas in BCP will be required to meet the local housing need and increase supply to make homes more affordable to locals.

It will also be able to provide more affordable housing that the town centre schemes have struggled to do. Green Belt release for development sites has been proposed in Poole’s draft Local Plan and this strategy needs to be replicated across the rest of the combined area. The proposed Stour Valley Country Park could be delivered alongside these new development sites which would create better quality publicly accessible open space.

New infrastructure including schools and medical centres provided as part of large scale development would serve the wider community as well as new residents.

BCP has the opportunity to build on its existing employment strengths as well as the digital infrastructure and growing tech scene. But the right kind of space and support will be needed to do so. The challenge for BCP is to ensure that it provides enough top quality floorspace to attract occupiers. With flat rents and rising build costs restricting viability, there has been limited new office stock provided in BCP over the last 25 years.

In 2018, 46,000 sq ft of new office space was completed at the Lansdowne as part of the requirements building student accommodation. This space was successfully let to a tech company prior to completion showing that new office space is in demand.

The Lansdowne area is being developed into a ’world class’ business district supported by £8.5m of government grants. Several sites from the railway station to the Lansdowne and St Swithun’s roundabouts have been earmarked for offices, residential and student housing to transform this area. Student housing and academic space has dominated development at the Lansdowne to date but 5G and superfast broadband in the area is a unique offering to companies.

More schemes will need to be built in conjunction with other uses as well as more private and public partnerships to ensure the area receives the new office development it needs.

Growth areas Key constraints and areas for growth in BCP

Source: Savills Research

We identify three key locations for workspace growth as a result of the merging of the three authorities:

The digital village at Talbot Heath, adjacent to both universities, is ideally located to accommodate the type of space needed by the tech/media/creative sector. It is also well placed to capture the talent generated at the universities and retain graduates. BCP will need to work with the universities, landowners and LEP to provide incubator space and to encourage and support spin off start-up companies to develop this sector to its full potential.

Bristol and Southampton are examples where the universities have worked with SetSquare (a partnership funded by the Higher Education Innovation Fund) to commercialise their work. In the case of Bristol this has meant setting up an award-winning incubator space for 80 start-ups. With borough boundaries removed, the Talbot Campus is a great opportunity for growth at the centre of the new BCP unitary authority.

The business park at the airport is home to several major aviation engineering companies and a host of other occupiers. With greater capacity at the airport, several development sites and an existing business community it provides the opportunity and space to grow and attract more, similar businesses. The recent change in ownership promises revitalisation.

Improvements to the road network have helped to make the area more connected although more needs to be done to allow it to reach its full potential. Having one unitary authority will make it easier to deliver a coherent strategy to link the airport (in Christchurch) with Wessex Fields (in Bournemouth) and the key commercial centres. This will help meet the LEP’s aims to use the airport and Wessex fields to drive economic growth.

There is a concentration of marine engineering companies at Poole Harbour and 36,000 sqm of employment space is planned as part of regeneration of the area. Unlike other locations in the South Coast Marine Cluster it has no Research and Development facilities. With 86% of the South Coast Marine Cluster companies expecting to expand in the next year, Poole will need to stand out to attract this growth.

If the 5G testbed at the Lansdowne in Bournemouth could be extended across the BCP area as a result of the merger, this combined with the superfast broadband available could be a strong draw for new marine engineering and R&D companies. Branding itself as somewhere with the best digital infrastructure will also help improve the perception of the area and attract new businesses.

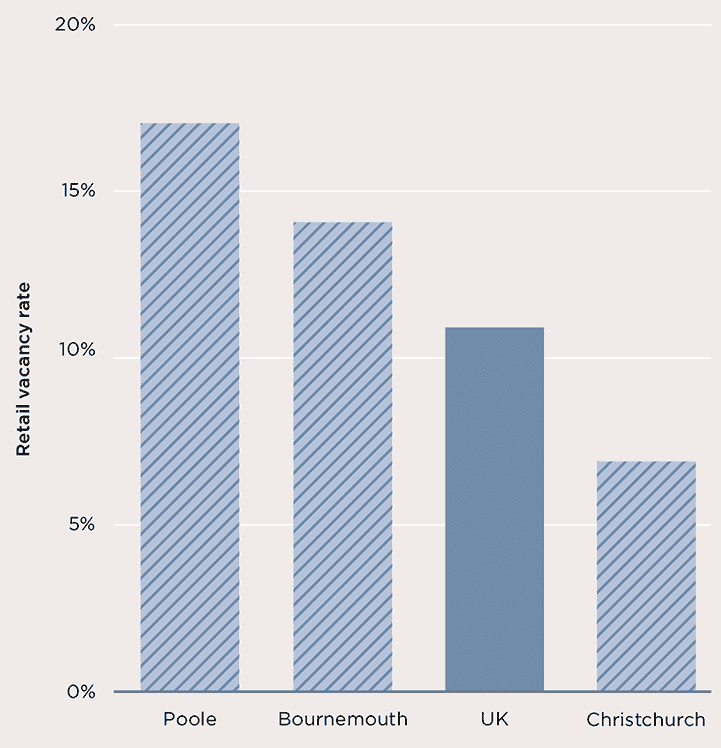

We assess that there is enough retail space within BCP to meet the local need. Mature high street retail supply is focused around the three principal town centres, as well as Boscombe town centre and Castlepoint shopping centre. There is also a strong presence of out of town retail parks, extensive supermarket provision and several large parades throughout the wider conurbation.

However, there are issues surrounding the quality of supply and in particular the amount of redundant floorspace. Therefore, offering an opportunity for some retail space to be re-purposed.

There is a significant opportunity from the merging of the boroughs to create a more co-ordinated strategy to recognise what is unique or beneficial with each of the main retail centres complementing each other rather than competing.

In addition, there are opportunities to redevelop excess or marginalised retail space through alternative town centre uses. This could include residential, office/workspace, social/amenity, civic/community, or leisure. The implications of an ambitious forward thinking and targeted approach to enhancing the town centre ultimately can have a positive impact on footfall, vitality, social integration and strengthen the demand for the retail and leisure space.

Focusing on enhancing key retail areas with investment in public realm will help drive footfall and uplift retail areas but this should be concentrating on the core retail areas rather than expanding them. Investment in developing the cinema complex in Poole is hoped to boost the local area enhancing the public realm as well as providing better amenities.

Retail vacancy Above the UK average

Source: Savills Research

Student Housing

Development in Bournemouth town centre has been focused on student accommodation over the last five years. There are currently 5,700 purpose build student beds in Bournemouth for the 23,500 student population, sufficient to house 31% of full time students. An additional 2,100 beds are in the development pipeline. Once these extra beds have been completed, there will be enough beds to accommodate 42% of full time students in the town.

.jpg)

3 other article(s) in this publication