Abstract

What are second home buyers seeking, and how are they funding their purchase? Here's an overview of the second home market today

.jpg)

What are second home buyers seeking, and how are they funding their purchase? Here's an overview of the second home market today

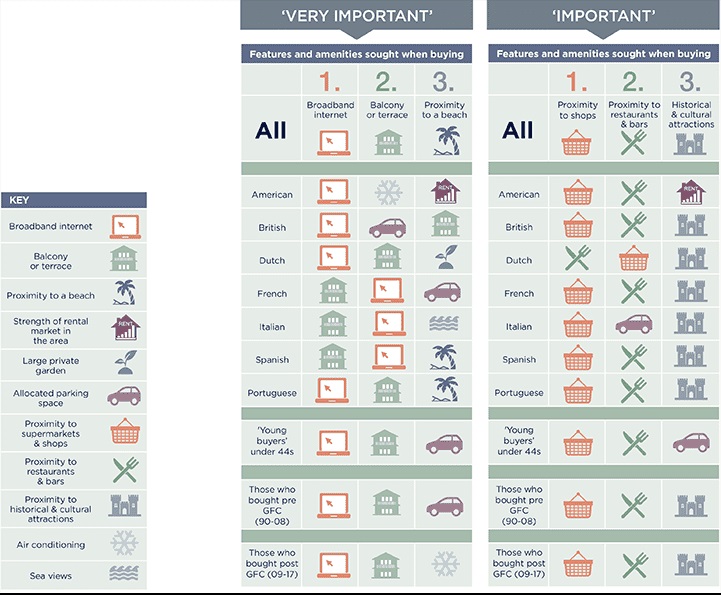

What are purchasers' priorities when choosing a property? The availability of broadband is the single most important feature cited by owners when choosing a property. In the digital age, connectivity is key, a factor common across all nationalities and ages (see chart).

FIGURE 5 | Top factors deemed ‘Very important' versus ‘Important’ Features and amenities sought when buying

Source: Savills World Research & HomeAway

The next most important factors are property-specific, such as balconies and terraces and also the availability of parking. Proximity to a beach is an absolute must-have for many, as is air conditioning. These are all ‘very important’ features that might be considered non-negotiable in property searches.

When broadening to ‘important’ factors, local amenities come into play. Proximity to shops, restaurants, and local cultural attractions all rank highly. Seeking a ‘home from home’, convenient local amenities and entertainment are highly demanded features in a second home by owners.

Developers of resorts where a proportion of accommodation is targeted at second home owners therefore need to understand the importance of creating (or finding a site in) the right type of location. Mixed-use neighbourhoods and a sense of place will have an impact on the saleability of a scheme – even if it isn’t a ‘must have’ from the short-term holidaymakers they usually cater to.

The strength of the local rental market is another important factor, and reflects current owner emphasis on income. This is particularly the case for American, Dutch and ‘young’ owners (under 44s), and those who bought their property after the GFC. Good, evidence-backed advice on rent levels, voids and running costs will be of increasing importance to buyers.

Golf's in a hole?

Many purpose-built resorts targeted at second home buyers have a golf course at their heart. Proximity to a golf course (whether on or off site) is a feature in a third of all properties in our sample of owners, but its appeal to buyers appears to be waning.

Being close to a golf course was cited as ‘not important’ by 45% of all respondents, and by 55% of British owners surveyed (compared to 32% in 2011). For developers, using golf courses as a major selling point may not be the marketable asset it once was. Second-hand sellers on golf courses may also find that their property no longer commands the premium value they once expected.

Cash is King

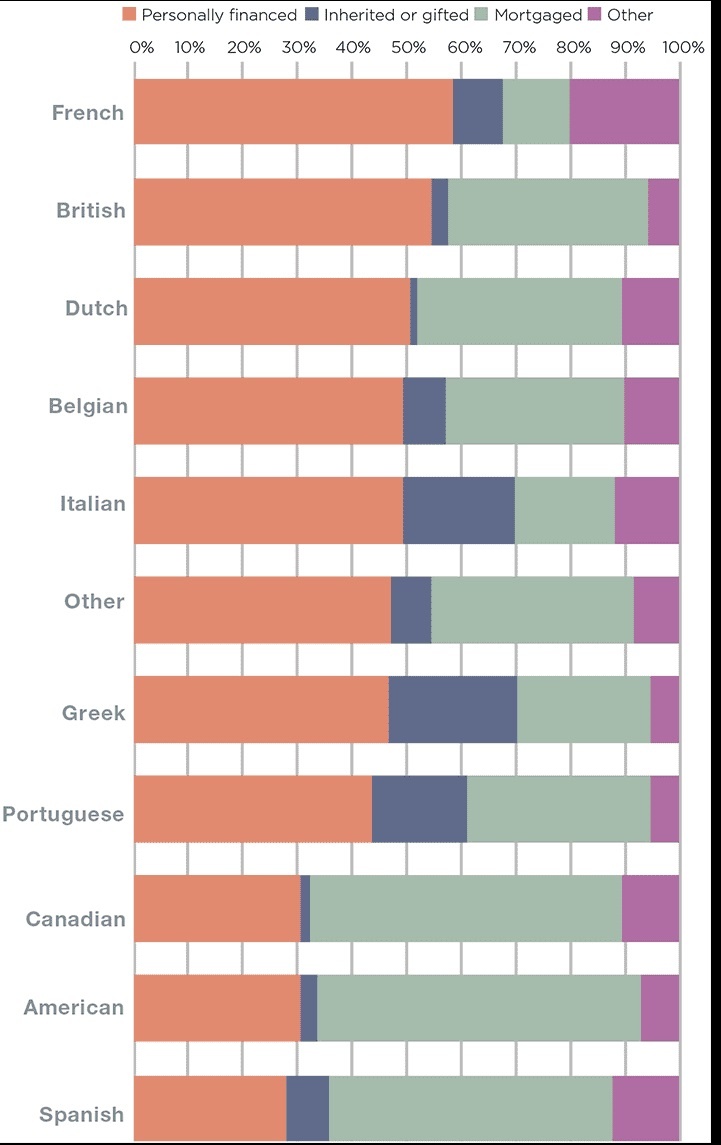

The majority of home owners (45%) self-financed their second property (i.e. without using a mortgage). Financing behaviour varies by nationality.

Well over half (59%) of American owners took out a mortgage in some form, usually in the US rather than the country of purchase. Spanish owners are also far more inclined to mortgage (52%) when compared to their European counterparts, often putting their main residence up for security. Southern Europeans are generally more likely to have inherited their second homes.

The share of homes financed by mortgage borrowing peaked in the lead up to the GFC, when it accounted for 43% of property finance. In 2017, a mortgage was used in 35% of second homes purchased.

FIGURE 6 | Source of property finance by nationality Most finance personally, but mortgaging plays a role

Source: Savills World Research & HomeAway

6 other article(s) in this publication