Abstract

HNWIs and emerging market wealth will continue to drive expansion of the sector

.png)

HNWIs and emerging market wealth will continue to drive expansion of the sector

The market is expanding geographically

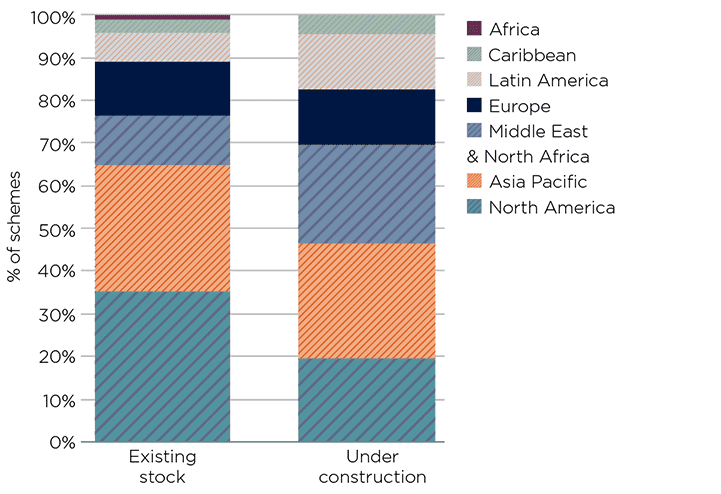

Our analysis of existing supply and projects currently under construction suggests a broader geographic spread than ever before. Over a quarter of projects currently under construction are in Asia Pacific (27%), closely followed by the Middle East and North Africa (23%), 14% in Europe and 13% in Latin America. At a country level, the UAE, Mexico and Indonesia have the largest pipelines outside the US.

Distribution of existing stock compared to short-term supply

Source: Savills World Research

Watch emerging countries

Branded residences can offer a solution to residents in emerging markets with immature residential property sectors. They offer comfort, security and familiarity.

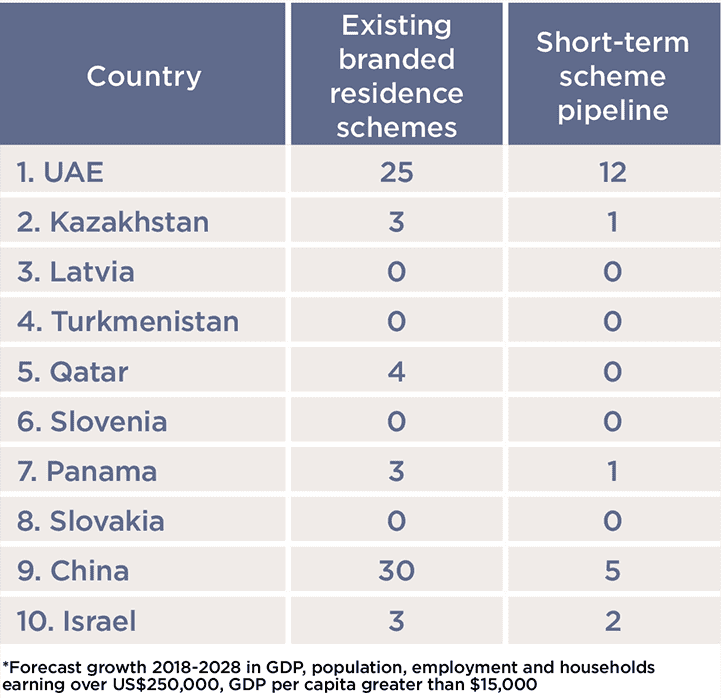

We have identified ‘emerged’ and ‘emerging’ countries with the best domestic growth prospects over next decade, making them strong contenders for future branded residence development. The UAE, a safe haven in the Middle East, ranks first and already has the largest pipeline of branded projects outside the US.

Kazakhstan, Qatar, Panama, China, and Israel all have at least a handful of branded projects, but positive underlying domestic growth prospects suggest room for more. Pioneering developers and operators may consider emerging Eastern European markets such as Latvia, Slovenia and Slovakia, or Turkmenistan, all currently unserved with no stock of projects in the pipeline.

Top 10 countries by domestic growth prospects*

Source: Savills World Research

Follow the money: HNWI trends

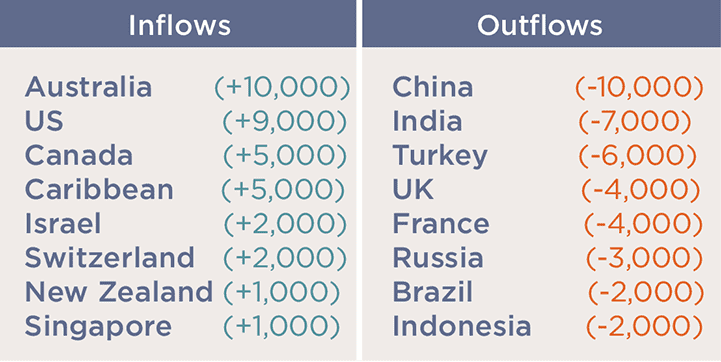

Popular destinations for globally mobile HNWIs, especially those that attract emerging wealth, are a natural base for branded residences. For those who may be buying abroad for the first time, the presence of a brand instils buyer confidence.

Australia saw the largest inflow of HNWIs in 2017. As the country’s business centre, many HNWIs who migrate to Australia are likely to end up in Sydney. Currently, Sydney has just one branded residence scheme. Australia stands out as a market that has huge growth potential.

Global HNWI flows in 2017

Source: New World Wealth

5 other article(s) in this publication