Abstract

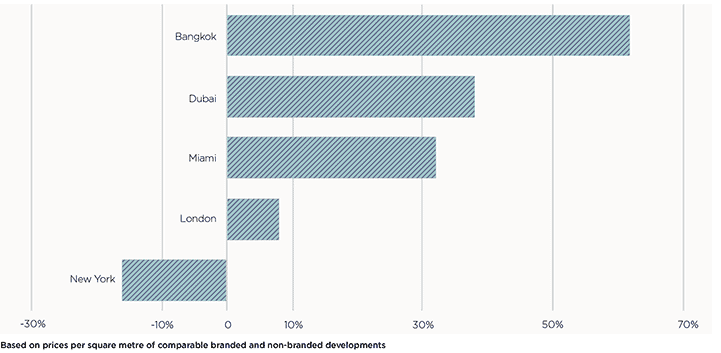

Our analysis shows an average premium for branded residences over non-branded product of 31%, but this varies significantly by location

.png)

Our analysis shows an average premium for branded residences over non-branded product of 31%, but this varies significantly by location

When a luxury brand is given to a residential product, it benefits from the same qualities of that brand by association and design. Purchasers of branded residences are assured of a quality product, limited in supply, that shares in the values of the brand. Pre-existing brand awareness means that the residential product may enjoy greater profile and attract a larger demand base. For this reason, purchasers are willing to pay more for branded than non-branded property. Our analysis suggests that on average, branded residences achieve a price premium of 31%, but this varies significantly by location.

The largest premiums are usually achieved in emerging markets. Luxury brands have proved appealing to the newly wealthy, by whom they are viewed as a mark of success. Owning a branded property is seen as both status affirming and a safer investment choice. Premiums are also larger in these markets because the standard of branded properties are usually so much higher than existing and even new-build non-branded stock.

Analysis of current prices at the Ritz-Carlton Residences in Bangkok, located in Thailand’s tallest building, MahaNakhon, show that premiums can exceed 80% over competing, non-branded stock. Where a branded development is the first to bring prime property of international standards to an emerging market, premiums can be even greater. For example, branded residence premiums of 90% over existing prime stock have been achieved in Belgrade, Serbia. In Almaty, Kazakhstan, they have exceeded 150%.

In the case of European resort locations, premiums range from 20% to 45%. In this market, there is a balance to be struck between pricing and sales velocity, however, as evidence suggests that resort developments commanding the highest premiums also see slower sales velocities. Four Seasons’ Palazzo Tornabuoni, Florence, a conversion of a historic palazzo, achieved a 44% premium over comparable local prime stock. Amanzoe, an Aman Resort in Porto Heli, Greece, achieved a 40% premium over non-branded product. Pine Cliffs, a Luxury Collection resort in Portugal’s Algarve, sold strongly and achieved a 37% price premium.

Lesser premiums are achieved in more mature luxury markets, where prime stock of all types are of very high quality, and location is a greater determinant of value. Comparing equivalent branded and non-branded developments, in Dubai the premium stands at 38%, Miami 32%, and in London it is 8%. Analysis of recent sales prices in New York suggest in some cases a branded discount of 15%, as some exceptional, non-branded, buildings currently trade.

Branded residences sales price premiums by key cities

Source: Savills World Research

5 other article(s) in this publication