rural

Demand for farms with a variety of income streams will continue, which in turn will support values

.png)

Demand for farms with a variety of income streams will continue, which in turn will support values

The UK Government’s recently published Agriculture Bill sets out major post-Brexit policy. But this Bill will not be enacted in Scotland, as rural affairs are devolved. Nonetheless, the House of Commons Scottish Affairs Committee has launched an inquiry to investigate how any post-Brexit agricultural system could meet the needs of Scottish farmers and crofters. As we await announcements to understand to what extent policy will be influenced by Westminster, opportunities will undoubtedly surface, coupled with the pace of change for Land Reform.

Meanwhile, the resilience of farms and rural estates will be tested, particularly those that are heavily exposed to farming and especially in the red meat sector.

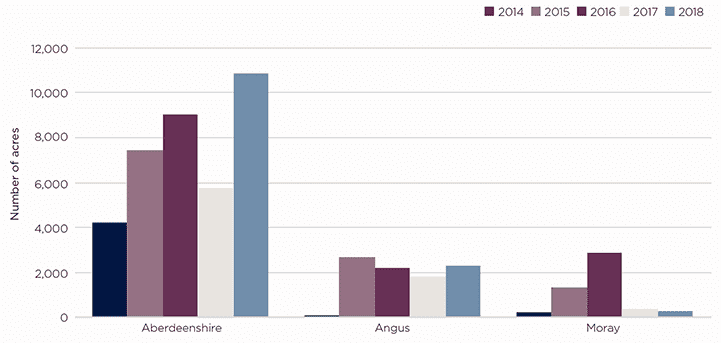

Farmland market activity across North East Scotland (January to September) Supply has caught-up, following a slow first half in 2018 affected by the weather

Source: Savills Research

Farmland supply rises

Across Scotland, 41,200 acres of farmland were publicly marketed during the first nine months of this year compared with 35,600 acres in the same period of 2017, an increase of 16%. This compares with a corresponding increase of 32% across England for the same period. Scotland accounted for 24% of farmland marketed in Britain and the North East of Scotland represented almost a third of this at 13,500 acres, with the majority located in Aberdeenshire.

.png)

Values remain stable

Average farmland values in Scotland have been relatively stable for the past five years whereas those in England peaked in 2015. Although there has been some correction in England, average Scottish values are currently trading at a 15% discount to those south of the border.

The Savills Farmland Value Survey records average prime arable land, excluding fixed equipment, in Scotland at £7,640 per acre. Average grassland is just under £3,000 per acre. However, there were a wide range of prices achieved with grassland farms exceeding £5,000 per acre and the best arable farms making more than £10,000 per acre. Indeed, value can vary by over £10,000 per acre within 40 miles, depending on quality, location and local demand.

.png)

Demand going forward

Looking ahead, amenity farms and those with a variety of income streams will continue to be in demand. In contrast, commercial units in need of investment, without the scope to diversify, are more likely to come under pressure, unless there are neighbouring farms looking to expand.

5 other article(s) in this publication