residential market

Paris’s prime market has recorded its best performance since 2011, with prices up across the board. However, some arrondissements have fared better than others

.png)

Paris’s prime market has recorded its best performance since 2011, with prices up across the board. However, some arrondissements have fared better than others

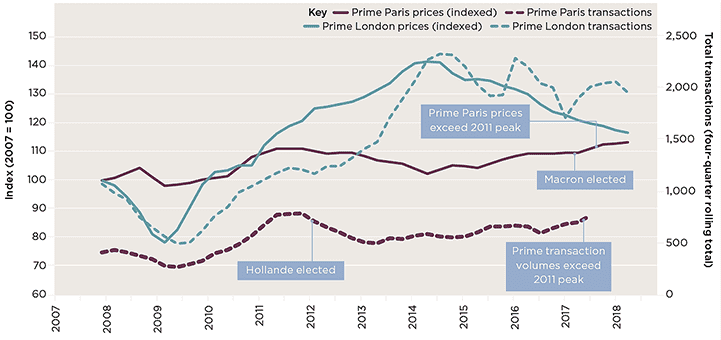

Prime Paris residential prices have now risen for four successive years, up 3.5% in the year to June 2018. Transaction volumes exceeded their 2011 peak at the end of 2017, as domestic and international buyers, as well as returning French expats, competed for available stock.

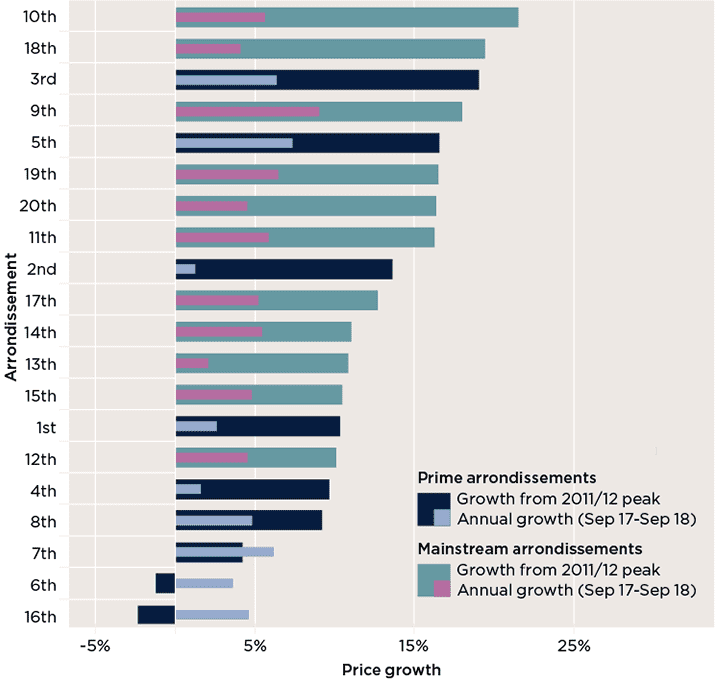

Prices are now rising all across Paris, with the 3rd the best-performing prime arrondissement

Savills World Research

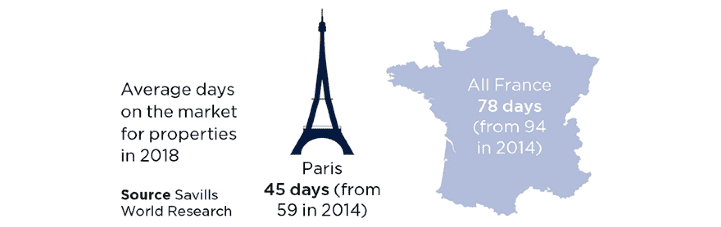

According to the Chambre des Notaires de Paris, average prices across the city stand at €9,300 per sq m (as at Q2 2018). Prime prices range between €12,000 and €20,000 per sq m, with ultra prime prices starting at €20,000 per sq m (see prime definitions). An average Paris property is now on the market for just 45 days (down from 59 in 2014), though momentum is beginning to slow as buyer and seller expectations have become misaligned in a rising market.

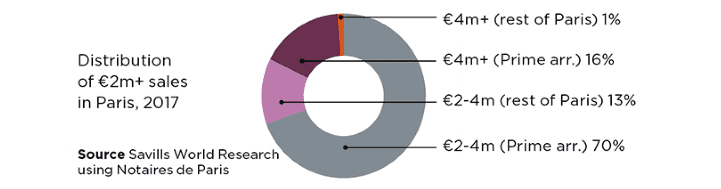

Prices are now rising all across Paris, and 86% of transactions over €2 million took place in the prime arrondissements last year (see chart, below). But our analysis reveals the relative underperformance of some of the best-established prime arrondissements over the longer term.

Prices in the 16th arrondissement grew by 4.6% in the year to September 2018, but remain 2.4% below their 2011 high. Characterised by large properties just outside the core, the 16th was the district hardest hit during the market downturn. The 6th, 7th and 8th – among the most expensive arrondissements – have also recorded lower levels of growth since their former highs, though all are now seeing price rises (see bar chart, below).

Paris price growth by arrondissement Including prime and mainstream districts, to September 2018

Source: Savills World Research, MeilleursAgents.com

Luxury apartment, Champs-Élysées, Paris

Where the 3rd comes first

The best-performing prime arrondissement has been the 3rd, where prices stand 16.6% above 2011 levels, increasing by 23.1% in the last five years. North of the Marais, this small but well-located district offers an extensive range of independent retail outlets and restaurants, and has risen in stature.

The 10th, meanwhile, is the best-performing ‘mainstream arrondissement’. Prices here are now 21.5% above the former high of 2012, and have increased by 21.8% in the last five years. With parallels to London’s King’s Cross area, this regenerating district is home to the Saint-Martin Canal and two major railway stations – Gare de l’Est and Gare du Nord – the latter of which provides direct links to London.

Prime Paris and London compared The French capital is steadily rising

Notes: Prime Paris prices: transactions over €1.8m across all of Paris. Prime London prices: Savills Prime London Index. Prime Paris transactions: transactions over €2m across all of Paris. Prime London transactions: transactions over £2m across all of London.

Source: Savills World Research, MeilleursAgents.com, Chambre des Notaires de Paris, Lonres

Foreign buyers are back

In 2017, international buyers made 14% of all purchases in the prime market, up from 9% the year before. This is the highest proportion of international buyers since 2008. President Emmanuel Macron’s pro-business stance, along with France’s improved economic performance, has helped stimulate demand from foreign nationals.

Americans are especially active, attracted by the political environment and favourable exchange rate. Francophone Europeans – such as the Belgians and Swiss – are also present, along with buyers from the Middle East. The Chinese, a huge tourist group, are still to make their mark – perhaps because these buyers favour new builds, of which there are very few (most prime Paris stock is 19th-century).

Anecdotal evidence suggests that French expats are also returning to Paris. French citizens who left for London and Brussels in the Hollande era are now investing in Parisian property, where they see value and growth potential.

4 other article(s) in this publication