commercial

While headlines are dominated by economic uncertainty, office take-up in central London suggests there is ongoing housing demand from those in key employment sectors

.png)

While headlines are dominated by economic uncertainty, office take-up in central London suggests there is ongoing housing demand from those in key employment sectors

With business confidence remaining comparatively weak since the referendum on the UK’s membership of the EU, it would be reasonable to assume that expansion plans were being dialled back and demand for office space would be cooling. However, while the take-up of office space in the central London office market did fall year on year in 2016, the story in 2017 and 2018 has been very different.

Last year, the total amount of office space let across the City and West End totalled 12.6 million sq ft, the highest level of take-up for 20 years.

There is an active need for more than 7.2 million sq ft of office space in central London

Another sign of confidence in London’s future was the type of companies that took space, and the length of commitment. In 2017, the largest letting in the City of London was 564,000 sq ft, at 21 Moorfields, to Deutsche Bank. This was significant on two levels. A German bank was committing to a large new headquarters, and it was doing so on a pre-let of a building that will not be delivered until 2021.

Business confidence for London

Given that much of the post-referendum speculation about London’s future has focused on the prospects of jobs in banking and financial services leaving the capital, it may also come as a surprise that businesses from that sector acquired 2.4 million sq ft of office space in central London last year. This represented 15% of the total.

Other business sectors that acquired a significant proportion of office space were the serviced office sector with 19% of the total, and the creative and technology sector (26% of the total).

These trends have broadly continued into 2018 with the amount of office space leased in the City of London and West End reaching 5.6 million sq ft at the half year. This is marginally up on the total at the same point last year and bodes well for the London office market.

This year has seen a slightly different tone around who has driven demand. During the first six months, the largest deal in the City has been the 600,000 sq ft at Royal Mint Court for the new Chinese Embassy.

This made the public sector the largest acquirer of office space, although insurance and financial services companies have also taken 825,000 sq ft of office space (21% of the total).

Businesses are actively looking for 7.2 million sq ft of office space across central London

Savills Research

Forecast for growth in office-based jobs

In the West End, the rise of the global tech titans has continued with Facebook’s pre-let of 600,000 sq ft of office space in King’s Cross. Once Facebook, Google, Amazon and Apple have moved into the office space that they have acquired in recent years, they will occupy more than 4 million sq ft in central London, room for nearly 40,000 workers. What is perhaps even more relevant in the context of Brexit, is that the majority of this new office space has been acquired since the referendum.

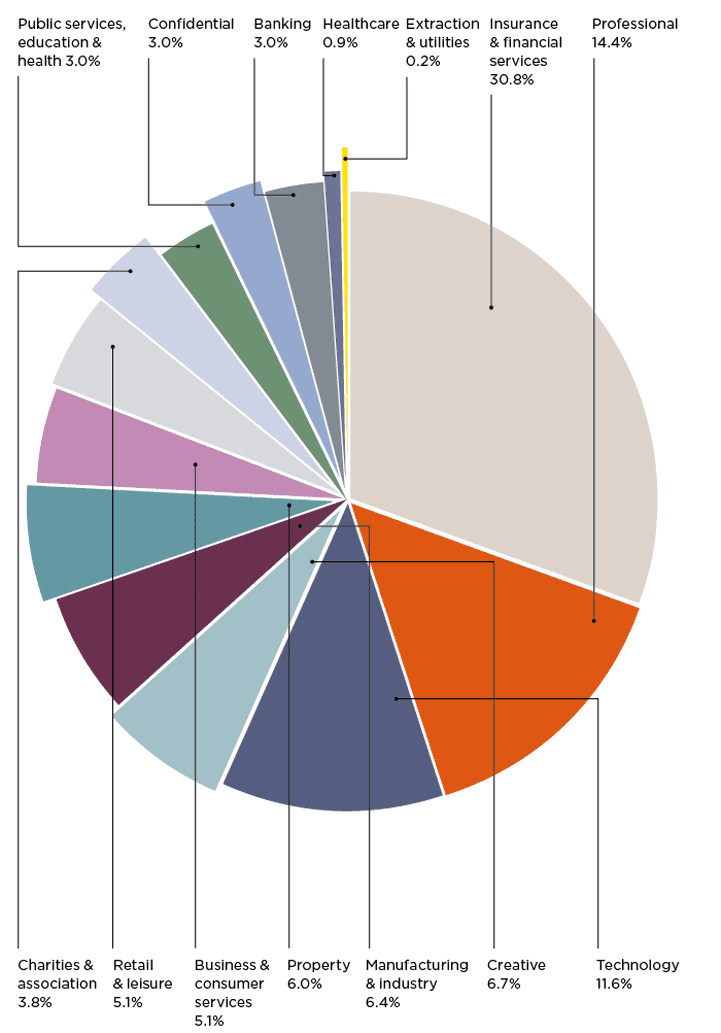

Looking ahead, the story on business expansion and demand for office space in central London appears equally positive. At present, there are active requirements for more than 7.2 million sq ft of office space from companies as diverse as the European Bank for Reconstruction and Development, Merck, and Samsung. Some 34% of these requirements are from businesses in the banking and finance sectors, and 19% of demand is from the technology and creative sectors.

While the mood music around a hard Brexit has definitely picked up pace over the summer, it is apparent from both the recent trend in office take-up and the level of requirements, that office-based employment in London will grow for the foreseeable future.

Businesses are more cautious than they were five years ago. However, larger companies are planning through the period of Brexit uncertainty and taking a view that London will remain a major part of their European and global network regardless of Brexit.

How to slice 7.2million sq ft The requirements, by business sector, for central London office space

Source: Savills Research

8 other article(s) in this publication