Abstract

With constrained existing unit supply and a strong development pipeline we expect quoting rents to exceed £6 in the next 12 months

.jpg)

With constrained existing unit supply and a strong development pipeline we expect quoting rents to exceed £6 in the next 12 months

Sheffield 615 which Logicor have leased to Clipper Logistics

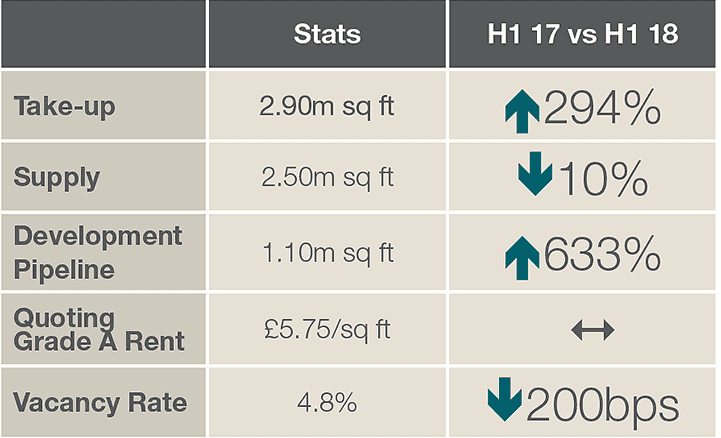

TABLE 5 | Key stats

Source: Savills Research

Supply

.png)

FIGURE 15 | Supply by size

Source: Savills Research

Take-up

.png)

FIGURE 16 | Take-up

Source: Savills Research

Development pipeline

.png)

FIGURE 17 | Speculative announcements

Source: Savills Research