Abstract

There are a number of sizeable requirements across the region being discussed and we anticipate significant activity in the second half of the year

.jpg)

There are a number of sizeable requirements across the region being discussed and we anticipate significant activity in the second half of the year

Former Lidl, Weston Super Mare

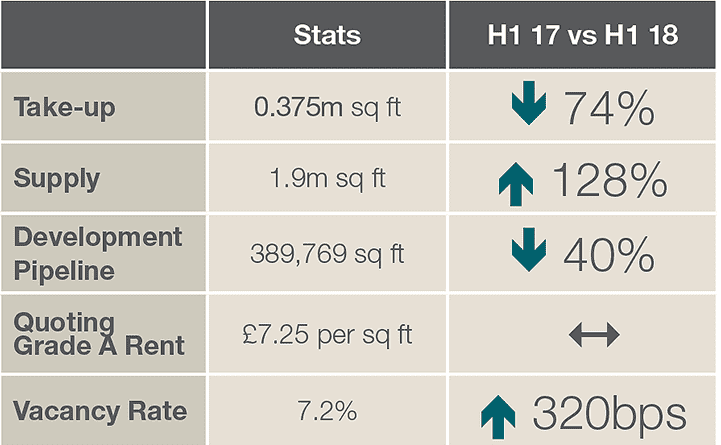

TABLE 6 | Key stats

Source: Savills Research

Supply

.png)

FIGURE 18 | Supply by grade

Source: Savills Research

Take-up

.png)

FIGURE 19 | Take-up

Source: Savills Research

Development pipeline

.png)

FIGURE 20 | Development pipeline

Source: Savills Research