Abstract

After a relatively sluggish first quarter, we are beginning to see take-up in line with the long term average. With a number of significant deals due to complete over summer, the region is set for another robust year

.jpg)

After a relatively sluggish first quarter, we are beginning to see take-up in line with the long term average. With a number of significant deals due to complete over summer, the region is set for another robust year

Mountpark Omega

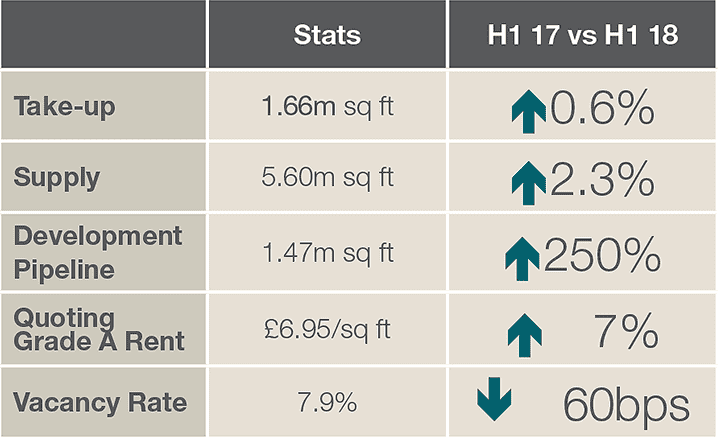

TABLE 4 | Key stats

Source: Savills Research

Supply

.png)

FIGURE 12 | Supply by grade

Source: Savills Research

Take-up

.png)

FIGURE 13 | Take-up by quarter

Source: Savills Research

Development pipeline

.png)

FIGURE 14 | Development pipeline

Source: Savills Research