Costs of production

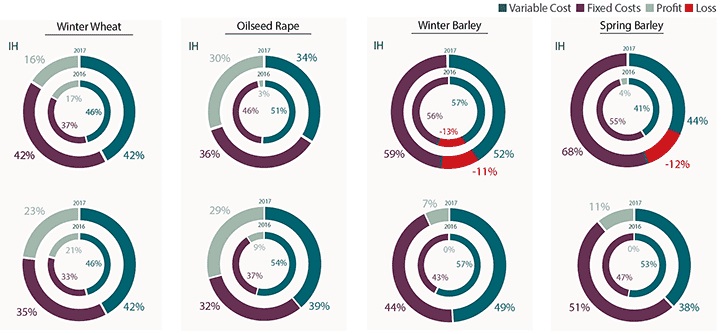

Variable costs

Variable costs associated with growing the crop are largely affected by the timing of buying decisions, as well as rates and type of product used. For the 2017 harvest early purchasers of nitrogen benefited. Agrochemical costs, particularly fungicides, were affected by decisions taken in the very dry spring of 2017, which accounted for some of the general reduction in variable costs per hectare.

The spend and overall usage of herbicides in winter wheat and oilseed rape remains robust as blackgrass control from pre-emergence herbicides remains a key tool in the prevention armoury.

Fixed costs

The fixed costs associated with growing a tonne of crop such as labour, machinery and energy are spread across the whole farm meaning it is easy to treat them as unavoidable and necessary costs.

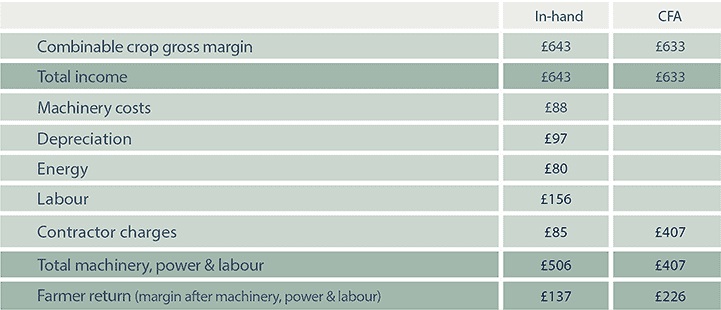

Instead businesses should allocate a proportion of fixed costs to the growing of a crop in order to fully understand the true cost of production and identify where savings can be made. Achieving economies of scale through careful planning and sharing costs across enterprises, with neighbours or entering into a CFA, can all help reduce fixed costs. If direct payments are reduced or stopped (as the Government is suggesting in its Agricultural Command Paper) then scrutinising costs will become even more important for all farm businesses.

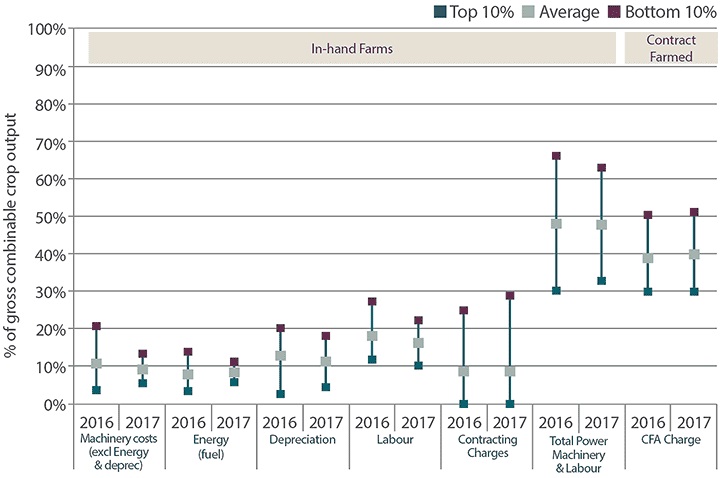

Measuring power, machinery and labour

Figure 3 shows the proportion of the power, machinery and labour costs along with the variable costs as a percentage of the average crop price. Despite rising fixed costs, higher crop prices and generally lower variable costs have resulted in costs making up a smaller proportion of the crop price in 2017.